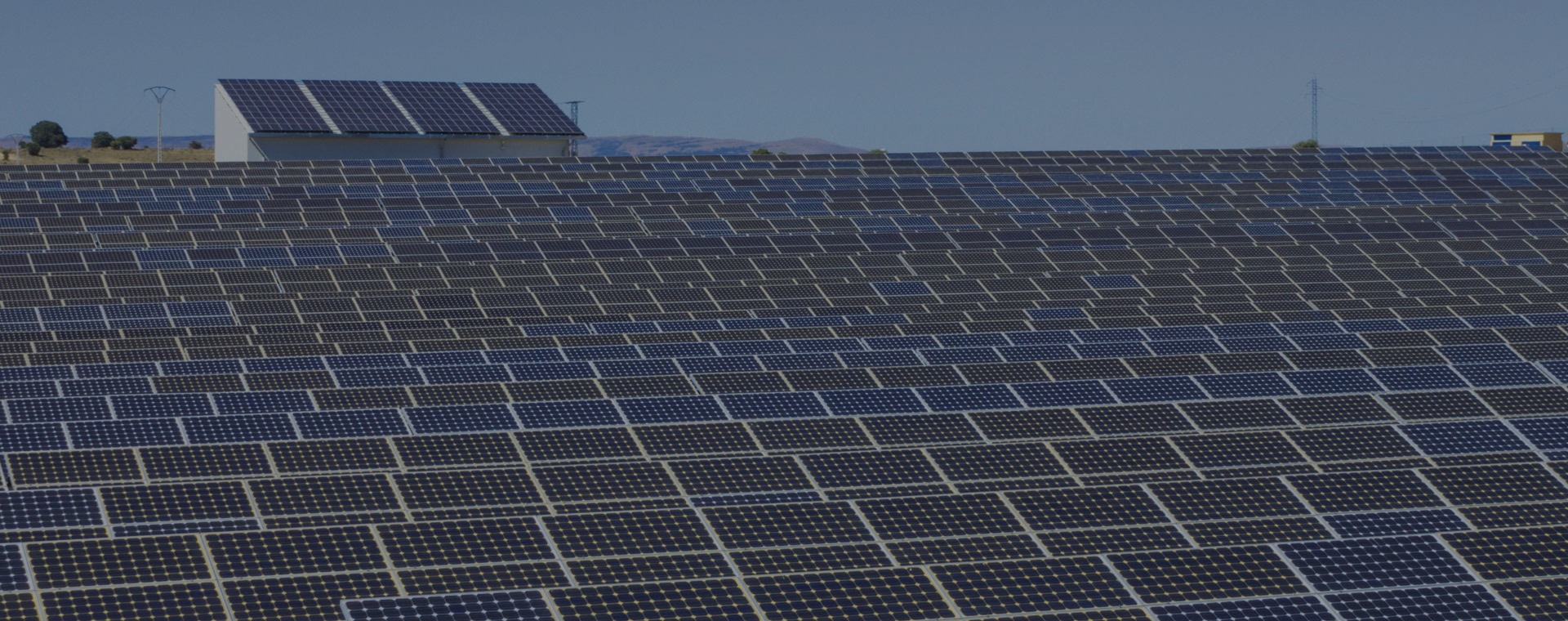

There is an increasing opportunity to innovate in solar markets in India thanks to the rapidly declining price of photovoltaics (PV). While large-scale ground-mounted solar parks are seeing tremendous growth, an area that still remains largely untapped is open access (OA) for the sector.

OA was one of the main components of the Electricity Act (2003), introduced in an effort to attract private investment in the electricity generation sector, thereby encouraging competition.

OA allows bulk consumers (>1 MW) to enter into agreements with independent power producers (IPPs) for procuring electricity via power trading markets. The involved parties would use the existing electricity network by paying a nominal fee, per kWh, to the operators.

In an effort to foster growth of renewable energy (RE) in Karnataka, the state government incorporated a clause in its RE policy in 2014 allowing OA for solar and wind without paying any fee till March 2018. The foundation has been laid for industries and others to access stable power at lower rates. However, implementation of OA in any state — whether for solar or from any other source — has not been smooth.

Among the biggest obstacles are the distribution companies (discoms) and their ailing finances. Karnataka’s discoms, like many in other states, are heavily reliant on industrial and commercial consumers for crucial revenue. OA threatens to take these consumers with its promise of power at cheaper rates.

Industrial and commercial consumers can achieve 25-40 per cent savings by signing solar OA power purchase agreements (PPAs) at Rs 4.6/kWh — the prevailing OA rate — instead of procuring power from discoms at more than Rs 6.75/kWh. Discoms vehemently oppose such agreements, citing technical and financial reasons. This has led to many solar developers, consumers and EPC (engineering procurment construction) players filing petitions at various levels of government and judiciary with little or no success.

Despite Karnataka’s initiative, its solar capacity linked to OA stands at less than 30 MW today. On the other hand, rooftop PV (RTPV) constitutes 40 GW out of India’s total 100 GW solar target for 2021-22. This sector, however, significantly lags behind large ground-mounted solar parks with only around 1.3 GW of the 12.8 GW solar installed capacity in the form of RTPV today.